Monthly Investment Thoughts On Digital Assets > Bitcoin

Welcome to DAIM’s Newsletter. DAIM is the first licensed registered investment advisor and asset manager for digital assets. #Bitcoin

We know shorter is better! Here is a link to a video summary of this letter.

1. May 2021 was the 3rd worst month for Bitcoin price, with plenty of media noise to distract us away from what’s being built and which new whales are making moves.

2. Is Bitcoin maturing from stock-like to bond-like?

3. State of Market is long term holders are holding or accumulating and miners are accumulating.

4. Arbitrum, a built-on for Ethereum, will likely launch on Uniswap reducing fees and allowing it to handle more transactions.

5. Forecast - Short term choppy, back half of June into the beginning of July bullish.

Full Letter

1.

Bitcoin experienced its third worst monthly price performance in May. And there were plenty of headlines about Elon Musk, ESG, and Chinese mining spewed by mainstream media designed to distract and drive fear. These FUD tactics are nothing new, but they still create plenty of noise to filter through, making it difficult to see what’s being built and who’s making moves. While most people were fixated on the Elon narrative, some of the most influential names in finance were quietly revealing their [new] stance on Bitcoin and the cryptocurrency space in general. Let’s recap.

David Rubenstein, of Carlyle Group, was quoted as saying “crypto has come from nowhere to a force in the market. It’s here to stay. Crypto is not going away. It’s here because people in the market want something other than traditional currencies that we’ve had. Whether that’s right or wrong, that’s clearly something the market wants. The idea that crypto is going away, or that the government is going to be able to stop crypto from something inventors want, is unrealistic at this point.” Let’s keep in mind that David hired Jerome Powell before he became the 16th chair of the Federal Reserve. Carlyle Group also happens to be one of the largest PE firms in the world.

Carl Icahn, U.S. billionaire and one-time cryptocurrency skeptic, is contemplating a potential $1.5 billion investment in digital currencies. During a Bloomberg interview, the activist investor said he’s looking at investing in crypto in “a relatively big way,” clarifying that “big” could mean “a billion dollars, or billion-and-a-half.” Icahn also said he believes crypto assets are “here to stay in one form or another,” before being pressed on how much he would consider buying through his investing conglomerate, Icahn Enterprises.

Ray Dalio, American billionaire investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, revealed in a May 6th interview, “I have some Bitcoin.” Dalio also said that Bitcoin’s “greatest risk is its success.” The hedge fund manager has previously called Bitcoin “one hell of an invention” and that he found it challenging to put a value on digital assets. Dalio has been considering cryptocurrencies as investments for new funds that would offer clients protection against the debasement of fiat money. Dalio has also been bearish about bonds for some time, saying in March that the economics of investing in bonds “has become stupid because they pay less than inflation.”

2.

This leads us into a growing hypothesis among some thought-leaders that Bitcoin may be maturing from an equity-like product into more of a bond-like product. With inflation creeping in, there are some linking Bitcoin to bond markets, and thinking of Bitcoin as an insurance against a sovereign default.

If you can read or listen to anything by Greg Foss, CFO and Bitcoin Strategist at Validus Power Corp., it is definitely worth your time. Greg recently stated, “What role do bonds play in your portfolio? Supposedly equities are where you get your appreciation and where you gain most of your returns. People hold bonds primarily for safety, for protection. Bonds are the part of your portfolio that is intended to beat inflation. Bonds are considered the risk free rate.”

For many, the case for holding Bitcoin over Bonds is becoming more convincing. Bonds are always going to survive because the world needs debt. Debt is the way capitalism works. There will always be bonds. The argument being made however is to take your allocation to Bitcoin out of your allocation to Bonds. Think about it: Bonds have ridden a 40-year decline in interest rates, from 14% down to <1% in the US ten-year. People felt good because of the way bond math works: if interest rates go down, bond prices go up.

Here’s some Greg Foss bond math if you’re interested. Otherwise, skip to the next paragraph.

“The US ten-year hit a 60 basis point low and now is trading about a hundred basis points higher. Well, simple bond math would tell you that that 60 basis points yield to maturity that you invested in for 10 years one year ago has just lost about eight bucks, or 8%, because yields have gone from 60 basis points to 160 basis points. You just lost eight bucks. Ok, let’s do it on a 30 year bond. The 30 year bond that was issued a year ago at a 1.25% coupon that now has a yield of 2.4% because that’s the going rate in the US 30 year. That bond has lost $25. How is that capital preservation? You just lost 25% of your money!”

We know that bonds are an extremely important asset class, and they’re not going away. In Greg Foss’ words, “bonds have lived the beauty of mathematics, and went from an interest rate of 14% down to an interest rate of under 1% in the US ten-year. And now they’re going somewhere else. And guess what? They don’t go to negative 15%.” So where do we reallocate? Greg’s current opinion is converting your 60:40 portfolio into something like 60:25:15 - where the 15 points allocated to Bitcoin should come out of your fixed income portfolio.

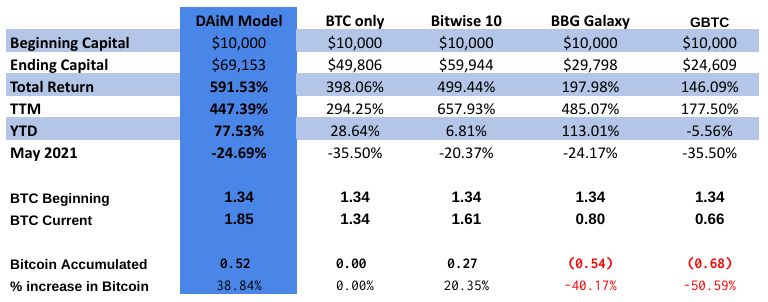

DAIM may not carry as aggressive a stance as Greg’s 15% Bitcoin allocation, but our Modern Portfolio case has proven itself and supports the Bitcoin over Bond hypothesis

3.

Losses both unrealized and realized are painful. New market entrants are showing this through panic selling and distributing their newly acquired assets. On the other side are long term holders split between holding and accumulating. And clear conviction is being shown by miners who are accumulating. Since May 19th whales (holding at least 1k coins) have been increasing their supply.

4.

The Ethereum replacement narrative should be taking a back seat as a “bolt-on” starts gaining adoption. Coming to market is Arbitrum which lowers fees and speeds up transactions. The first major test for Arbitrum will be on Uniswap. The vote was 41m for it, none against it and reports are that the developers are already working on an interface for it and planning the deployment, which we project can be inside 6 months. Note: SushiSwap is also implementing Arbitrum.

5.

After a broad selloff, DeFi has had some shining moments as Bitcoin volume has come down. We think in the short term there is a potential to test $30k before moving through $40k and above. As charts reset, the wave generating herd has the chance to push prices in the direction it wants. We are around the end of the average volatility cycle and it is likely they focus not on negative press but rather on upgrades, thus turning the market back into an upward path.