Monthly Investment Thoughts On Digital Assets > Bitcoin

Welcome to DAIM’s Newsletter. DAIM is the first licensed investment advisor and asset manager for digital assets. #Bitcoin

Network effect - Instead of thinking about the current price of Bitcoin first every time, try thinking about value being brought to users and the motivation it’s giving non-users.

Comparing Bitcoin to land - Using land to show scarcity.

GBTC - Those tied to it are the largest tangible price movers.

Forecast - More waiting.

1. Network effect

In economics, a Network Effect is the phenomenon by which the value or utility a user derives from a good or service depends on the number of users of compatible products. Network effects are typically positive, resulting in a given user deriving more value from a product as other users join the same network. The adoption of a product by an additional user can be broken into two effects: an increase in the value to all other users ("total effect") and also the enhancement of other non-users' motivation for using the product ("marginal effect").

Cryptocurrencies such as Bitcoin, also feature network effects. Bitcoin's unique properties make it an attractive asset to users and investors. The more users that join the network, the more valuable and secure it becomes. This method creates incentive for users to join so that when the network and community grows, a network effect occurs, making it more likely that new people will also join.

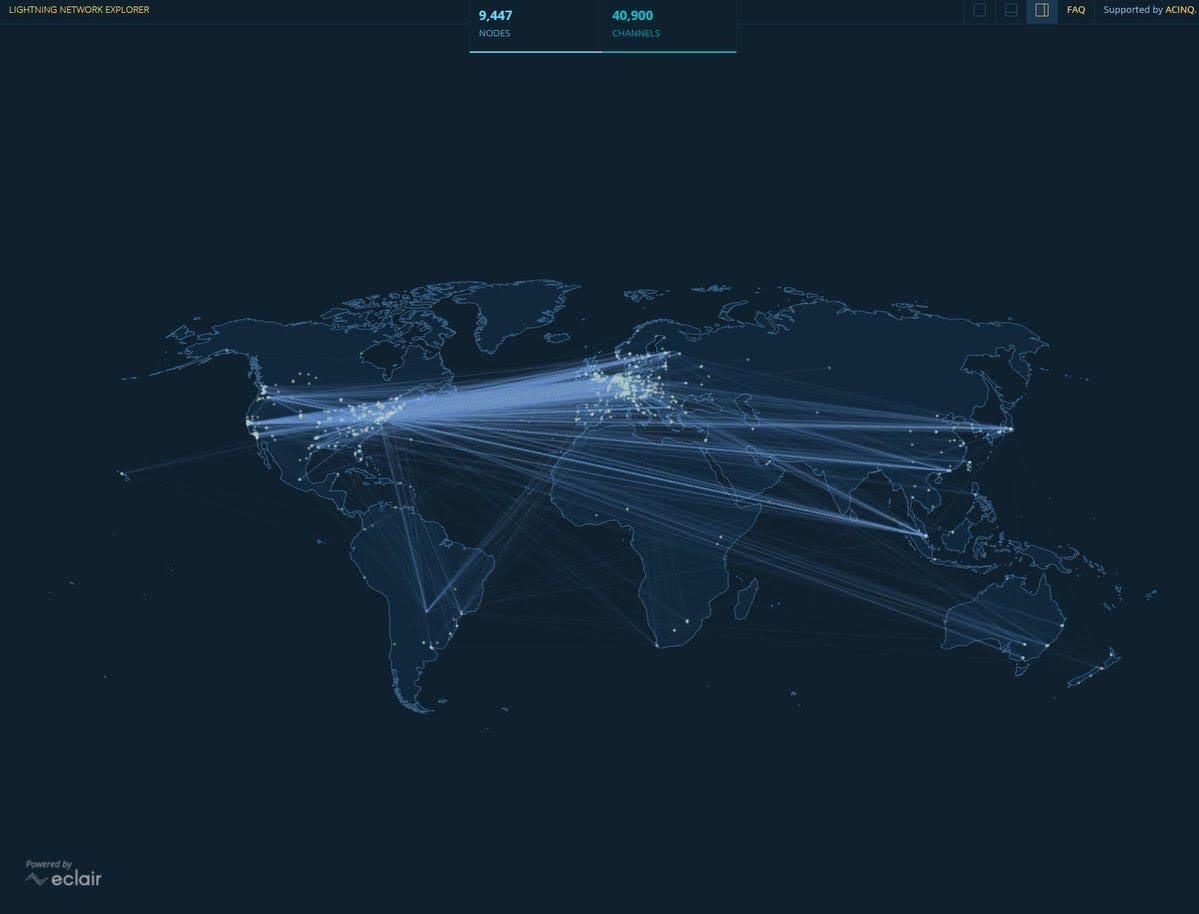

Lightning Network is designed to speed up transaction processing times and decrease the associated costs of Bitcoin’s blockchain. These pictures show “total effect” as the Lightning Network increases the value to all other users by making more connections and speeding up transactions.

The 1st image shows lazer eyes when El Salvador adopted Bitcoin. The 2nd image on the right shows the “marginal effect” of other countries being motivated to adopt Bitcoin.

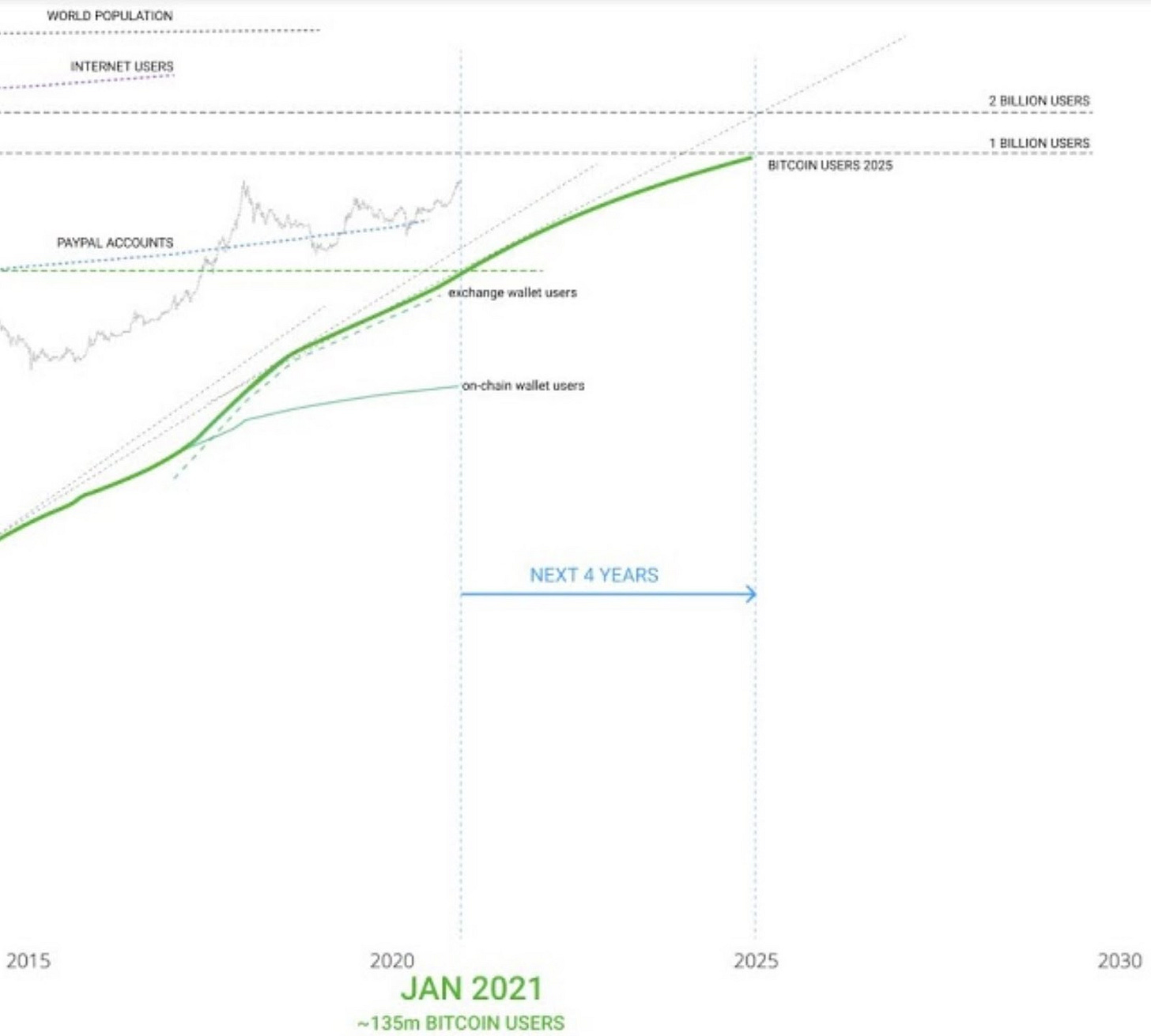

Willy Woo (@woonomics) produced a recent infographic comparing Bitcoin to the internet adoption. “In terms of adoption, Bitcoin has roughly the same users as the Internet had in 1997.

But Bitcoin's growing faster. On the current path, the next 4 years will bring Bitcoin users to 1b people. That's the equivalent of 2005 for the Internet.” Its worth checking out charts.woobull.com

Zoomed in.

2. Comparing Bitcoin to land

Here is an interesting way to look at Bitcoin in terms of land. @yassineARK

3. GBTC

We are going to propose a conversation starter about what the GBTC story will be in the mid term future. It is currently trading at a discount and Grayscale closed private placement. There are two reasons to close private placements. 1) There is something wrong, but this is not the case. 2) There is too much demand to handle still coming in from institutions. Right or wrong you cannot ignore GBTC’s massive position in the market and what goes on behind the curtain. We predict that the last institutions that got in at a discount will realize enhanced returns when GBTC’s nav normalizes and it converts into the first Bitcoin ETF.

4. Forecast

Short term: when BTC rises above $40k it will likely see selling pressure. Recently unlocked GBTC insiders will likely hold as they are flat in their unrealized returns. The range will stay bound between $25000-$45000 until we get through a few more months. The insiders who get unlocked in Sept and after will have higher BTC equivalent purchase prices and will hold, allowing BTC to rise above $45k. End of year we still foresee being at all time highs.